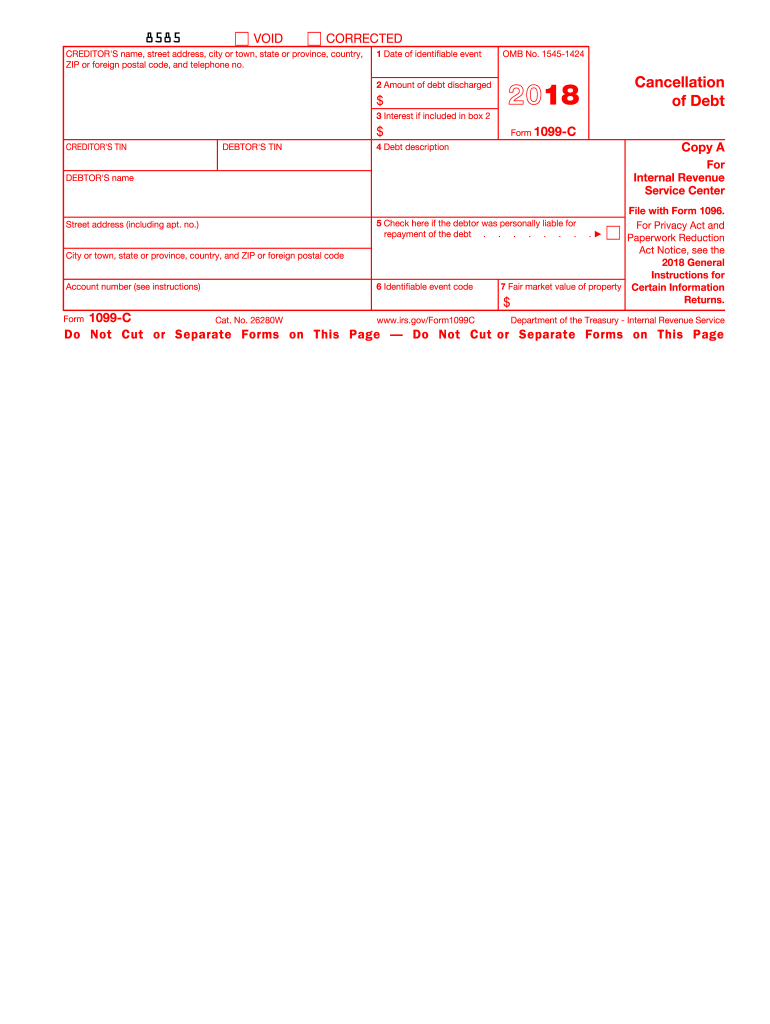

IRS 1099-C 2018 free printable template

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

About IRS 1099-C 2018 previous version

What is IRS 1099-C?

Who needs the form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about IRS 1099-C

What should I do if I realize I made a mistake after submitting my IRS 1099-C?

If you've submitted an IRS 1099-C with errors, you can amend it by filing a corrected version. Be sure to clearly indicate the corrections made when you resubmit. Additionally, if the original submission was electronic, follow the specific steps outlined by the IRS for electronic amendments to ensure proper processing.

How can I track the status of my submitted IRS 1099-C?

To verify the processing status of your IRS 1099-C, you can utilize the IRS's online tool or contact their customer service. Keep in mind that common e-file rejection codes may help identify any issues with your submission. Addressing these promptly can prevent delays in processing.

What should I know about filing IRS 1099-C for a nonresident foreign payee?

When filing an IRS 1099-C for a nonresident foreign payee, you must ensure compliance with specific IRS regulations relating to foreign transactions. Proper documentation may be needed to demonstrate tax withholding, and you might also have to consider any applicable tax treaties to avoid double taxation.

What are some common errors to avoid when filing IRS 1099-C?

Common errors include incorrect taxpayer identification numbers, misspelled names, and failing to report the correct amount of canceled debt. Taking steps to double-check entries and ensuring that all submitted data matches IRS records can help prevent these mistakes and subsequent penalties.

Can I use an e-signature when filing my IRS 1099-C?

Yes, an e-signature is acceptable for the IRS 1099-C filing, but it must meet IRS standards. Ensure that your e-signature method is compliant with the IRS rules on electronic filing to maintain the validity of your submission.

See what our users say